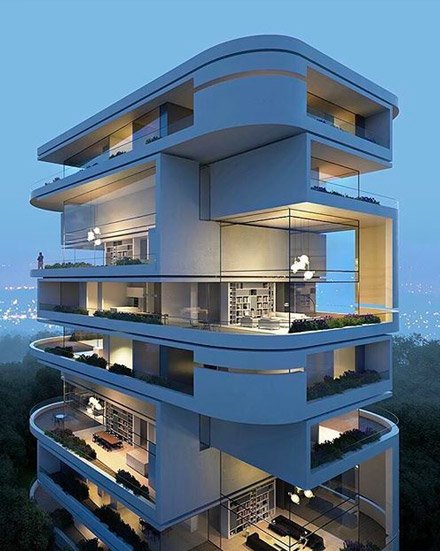

Home Loans Made Simple: Steps, Banks, and What to Expect

Dreaming of owning your own home? Securing a home loan is the first step to making that dream a reality. This guide will walk you through the simple steps of securing a home loan, choosing the right bank, and understanding what to expect throughout the process. Whether you’re buying a home in Kerala or elsewhere, we’ve simplified it for you!

Step 1: Check Your Eligibility

Before you apply for a home loan, it’s essential to check your eligibility. Banks will evaluate your credit score, income, age, and existing liabilities. Start by using an online eligibility calculator to get an idea of how much you can borrow.

Step 2: Prepare Your Documents

Gather the necessary documents to make the process smoother:

- Identity proof

- Address proof

- Income proof (salary slips, tax returns, etc.)

- Bank statements for the last 6 months

- Property documents (if you have a property in mind)

Step 3: Apply for the Loan

You can apply for the loan either online or at the bank branch. Fill out the application form, submit the necessary documents, and provide any additional information as required by the bank.

Step 4: Bank Review and Property Evaluation

After submission, the bank will review your application. In some cases, the bank may also conduct a property verification to ensure the title of the property is clear and the property is worth the loan amount.

Step 5: Loan Sanction & Terms Agreement

If approved, you will receive a sanction letter that outlines the loan amount, interest rate, tenure, and other terms. Be sure to review the terms carefully before signing.

Step 6: Sign the Agreement & Receive Funds

After signing the loan agreement, the funds will be disbursed either in lump sum or in installments, depending on the type of property and the agreement you’ve made with the bank.

“Understanding the home loan process makes home buying easy and stress-free.” – Canaba Realty

Choosing the Right Bank

Different banks offer different home loan options. Here are some things to consider when choosing the best bank for you:

- Interest Rates: Compare fixed-rate and floating-rate home loans. Fixed rates stay the same throughout the loan, while floating rates may change with market conditions.

- Processing Fees: Banks charge a fee for processing the home loan application. Compare processing fees and ensure there are no hidden charges.

- Loan Tenure: Home loan tenures typically range from 10 to 30 years. A longer tenure means smaller EMIs, but you will end up paying more in interest.

- Prepayment Options: Some banks allow you to pay off your loan early without penalties. Always check for this feature if you plan on paying off your loan before the tenure ends.

What to Expect During the Home Loan Process

The approval time for home loans varies, but it generally takes a few days to several weeks, depending on the bank and the documents submitted. Once approved, the loan will be disbursed in installments or as a lump sum.

Top Banks Offering Home Loans in Kerala

Here are a few of the top banks offering home loans in Kerala:

- State Bank of India (SBI): Known for competitive rates and a variety of home loan schemes.

- HDFC Bank: Offers home loans with flexible terms and attractive interest rates.

- ICICI Bank: Offers quick approvals and competitive floating interest rates.

- Axis Bank: Known for fast loan processing and flexible repayment options.

- Federal Bank: Ideal for both residents and NRIs, offering low processing charges and quick disbursement.

Tips for a Smooth Home Loan Journey:

– Maintain a Good Credit Score: A credit score above 700 will help you get better interest rates.

– Don’t Overborrow: Keep your EMI within 40% of your monthly income to ensure comfortable repayment.

– Choose the Right Tenure: Choose a loan tenure that suits your budget while keeping your EMIs manageable.

Conclusion:

Securing a home loan doesn’t have to be a stressful process. By following these steps and choosing the right bank, you can confidently move toward purchasing your dream home. Start your home-buying journey today and reach out to Canaba Realty for expert guidance.

Ready to Apply for Your Home Loan?

Contact Canaba Realty today to get the best home loan options and expert advice tailored to your needs.